66

indiana average investment yield state money

Penalty for Filing Late Taxes in Indiana | eHow.com

What Is an Interest Penalty on Unpaid State Taxes in Indiana? . This interest rate changes from year to year and is calculated by adding 2 percent to the state's investment yield. . Penalties for Not Filing Taxes When You Are Owed Money .

http://www.ehow.com/info_7953653_penalty-filing-late-taxes-indiana.html

ICI Return on Investment - The Independent Colleges of Indiana

remain scarce, it's more critical than ever that every state dollar yield the greatest return. Funds invested in students at Indiana's independent colleges and .

http://www.icindiana.org/research/ICI_chart_project_compendium.pdf

$300

Studio

About This Location

indiana average investment yield state money

IC 12-15-21-3 - State of Indiana

Information Maintained by the Office of Code Revision Indiana Legislative . the average investment yield on state money for the state's previous fiscal year, .

http://www.in.gov/legislative/ic/2010/title12/ar15/ch21.html

DOR: Indiana Department of Revenue Interest Rates - State of Indiana

Interest is assessed on amounts due to the Indiana Department of Revenue which . and is based on the average investment yield on state money for the state's .

http://www.in.gov/dor/4037.htm

State Farm – Money Market Fund

Investment Strategy. Unlike the other Funds, the State Farm Money Market Fund seeks to maintain a stable net asset value (“NAV”) of $1.00 per share. The Fund .

http://www.statefarm.com/mutual-funds/money-market-funds/money-market-fund-detail.asp

The 2012 Kiplinger 25: The Best No-Load Mutual Funds to Meet ...

The added risk means bigger cash payments. New Markets Income boasts a current yield of 4.8% (the average yield for intermediate-term bond funds is 3.4%) .

http://www.kiplinger.com/columns/fundwatch/archive/2012-kiplinger-25-best-no-load-mutual-funds.html

MainStay High Yield Municipal Bond Fund

Investment Objective. The MainStay High Yield Municipal Bond Fund's objective is to seek a high level of current income exempt from federal income taxes.

http://www.nylinvestments.com/portal/site/MainStay/menuitem.c708121e407f11409a05ec10ea48c1ca/?vgnextoid=160869b0cdb8c110VgnVCM740000ae841cacRCRD&aID=229

Underlying investments - Savingforcollege.com

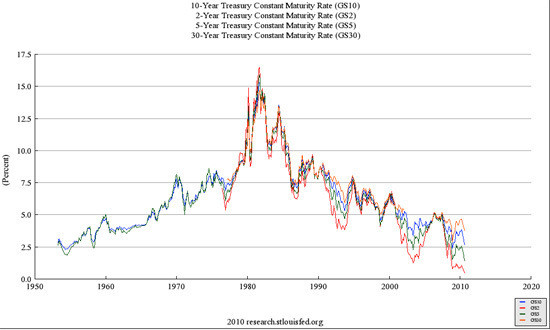

Alaska, Mutual funds from American Century Investments, American Funds, BlackRock, . Robeco, State Street Global Advisors, Stone Harbor Investment Partners, . Indiana, FDIC-insured certificates of deposit and a high-yield savings . rate based on the average five-year Constant Maturity Treasury Rate reported by the .

http://www.savingforcollege.com/compare_529_plans/?plan_question_ids%5B%5D=230&page=compare_plan_questions

usaa 5 digit insurance company code

4 Units

4 Units

1 Units

1 Units